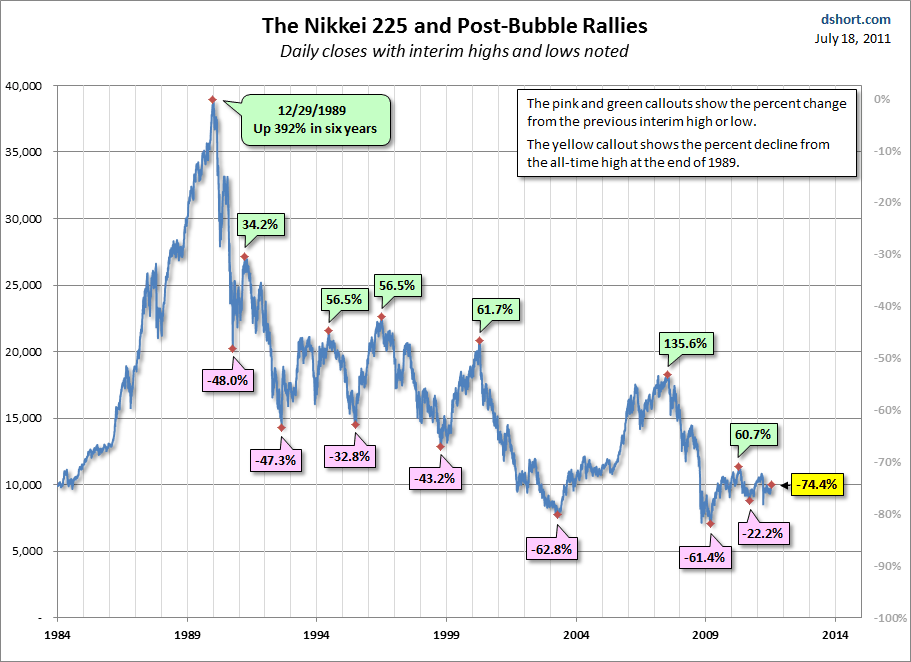

If the ASX followed the above pattern it will be 1700 in 2029 (cue shrieking and self harm).

Its a high volatility bear market.

The algo trading platforms (75% of NYSE volume) and the swing and trend traders will make a killing.

The equity oriented superannuant IS the kill.

ASX since 2007:

- down 53%,

- then up 56% on "US Fed QE stimulus" (still down 27% overall from 2007),

- then a current leg down of 16% (down 39% overall from 2007).

See the Big Picture Trend?

No comments:

Post a Comment