(Prospero uttering the opening line of Act V (the Final Act) of Shakespeare's The Tempest (circa 1610-11))

Its all coming together. Standard and Poors and the German government make strange bed fellows but

c'est la vie.

The US Problem.

If you haven't heard about USA's credit rating being downgraded to AA+ (same as Belgium and New Zealand) you've spent the last 48 hours asleep.

We'll keep to a simple picture. The two structures to the right comprised stacked $100 bills (100s not 1s!), the $15Trillion 'short' structure is the US Debt, the $114.5 Trillion 'tall' structure is its unfunded liabilities (Medicare, Social Security, Govt Pension Plans, Military etc it is the money the US knows it hasn't got to pay its bills and you can see it tickover in the bottom line here:

http://www.usdebtclock.org/

(click on pic to enlarge)

Some commentators are calling it the "Teaparty Downgrade" after the right wing nutters that control the Republican dominated congress. The movement that refuses to cut military spending and increase taxes on the rich. They believe that cuts should be implemented against the average Joe in the street, the Joe that borrows and spends and keeps the economy growing. Did someone say Depression?

Some perspectives on taxation and military spending are called for.

Tax rates on the super rich.

Buffett blasts system that lets him pay less tax than secretary.

Speaking at a $4,600-a-seat fundraiser in New York for Senator Hillary Clinton, Mr Buffett, who is worth an estimated $52 billion (£26 billion), said: “The 400 of us [here] pay a lower part of our income in taxes than our receptionists do, or our cleaning ladies, for that matter. If you’re in the luckiest 1 per cent of humanity, you owe it to the rest of humanity to think about the other 99 per cent.”

Mr Buffett said that he was taxed at 17.7 per cent on the $46 million he made last year, without trying to avoid paying higher taxes, while his secretary, who earned $60,000, was taxed at 30 per cent

.

17.7% without trying to evade/reduce tax? A problem? Apparently not.

Without trying to draw links to the 'foreign policies' that saw the demise of the Roman Empire I draw your attention to the failed expeditionary invasions over the last 10 years.

225,000 killed (7.8 million displaced), $3.2T-$4T.

The human and economic costs of these wars will continue for decades, some costs not peaking until mid-century. Many of the wars’ costs are invisible to Americans, buried in a variety of budgets, and so have not been counted or assessed. For example, while most people think the Pentagon war appropriations are equivalent to the wars’ budgetary costs, the true numbers are twice that, and the full economic cost of the wars much larger yet. Conservatively estimated, the war bills already paid and obligated to be paid are $3.2 trillion in constant dollars. A more reasonable estimate puts the number at nearly $4 trillion.

The German (Euro) Problem

As I predicted in earlier posts it appears the German's have realised that they are holding the can.

It Just Went From Bad To Far, Far Worse As Germany Says Italy Is Too Big For EFSF To Save, Refuses To Carry Euro Bailout Burden.

Dow Jones just hitting the tape referencing Spiegel

- German Govt: Italy Too Big For EFSF To Save - Spiegel

- German Govt: Doubts Whether Tripling EFSF Would Help It Save Italy

- German Govt: Italy Must Make Savings, Reforms To Exit Crisis - Spiegel

- Italy Debt Guarantee Could Raise Doubts Over Germany's Finances - Spiegel

- German Govt: EFSF Should Only Help Small, Mid-Size Countries - Spiegel

If Germany is now against this, which appears to be the case, it pretty much means, well, game over.

Add the uncerainty over the unwind of the Europe rescue "gamechanger" as one of the more naive CNBC anchors said yesterday, and Monday is now guaranteed to be a bloodbath.

Out of Ammo

Karen Maley is one of the sharper analysts at Business Spectator and she descibes the problem well. In GFC Act II (Act I was a decade of debt orgy) the governments of the world got into massive debts to 'stimulate' (aka

kick the can down the road) economies in the hope that consumers will take up the baton and borrow and spend. It failed, now the governments are in debt and the consumers in debt.

Is the global economy out of bullets?

Financial markets have realised that the major political achievements of the past three weeks – the eurozone’s latest bailout of Greece, and Washington’s debt ceiling deal – have done nothing to improve the bleak global economic outlook.

The US economy is faltering, as existing government stimulus programs taper off and the payroll tax break comes to an end. If anything, Washington’s debt deal has worsened the outlook. Some economists estimate that fiscal tightening is likely to shave about 1 percentage point off already stagnant US economic activity next year.

The eurozone, which is advocating a vigorous dose of austerity for its debt-laden members, is likely to see an even harsher decline in activity. The two largest eurozone countries, Germany and France, will both tighten fiscal policy in 2012, while harsh austerity programs will tip some of the southern eurozone countries into recession next year.

And even the Chinese growth engine is slowing slightly, as authorities battle with rising inflationary pressures which threaten to ignite social unrest

The problem is that governments in most developed countries have little option but to start embarking on a process of fiscal cut-backs. Years of deficit spending have left them with hugely bloated budgets, and soaring debt levels. As a result, they are under pressure to rein in their budget deficits, at a time when their economies are in desperate need of further stimulus.

Hats off Karen, a sound analysis in my opinion. And, pretty damned obvious. Although cut the Recession descriptor and go straight to Depression.

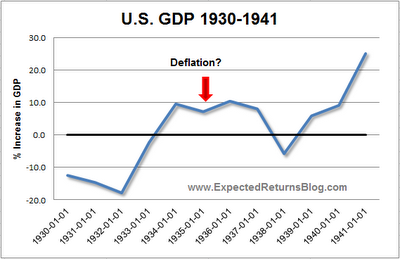

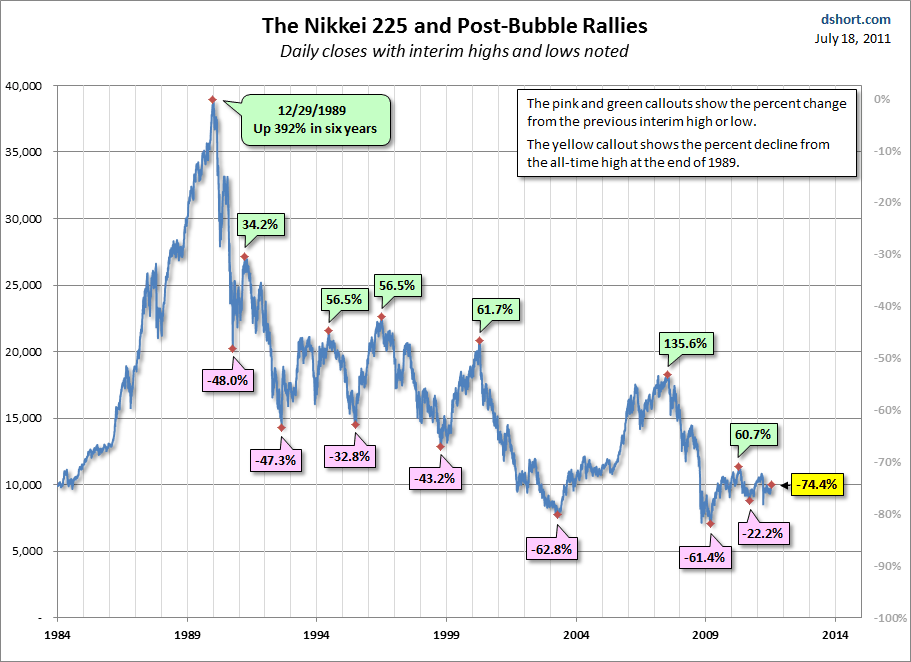

Has stimulus worked in previous Depressions? Never. Japan is still in the poop 22 years after its financial peak with its stock market hovering at around 25% of its 1990 highs.

In the 1930s, Roosevelt implented "The New Deal" which stimulated the US economy from its depression whilst the US borrowed heavily. It then started to double dip and was saved by World War 2 (Gulp!) where from the late 1930s the US was on a war footing in manufacturing and supplying allies in Europe (and Germans, Dubya's grandfather), they didn't join until December 7, 1941.

Kondratieff Winter

Kondratieff Super Cycles last 60 years and cycle through Prosperity, Recession, Depression, Improvement aka Summer, Autumn, Winter and Spring. The modern cycle is closing on Winter.

Modern Modifications of Kodratieff Theory.

(click on chart to expand)

The Kondratieff Winter is characterised by Deflation (a Deflationary Recession/Depression) it 'should' have started 10 years ago but the high borrowing and low interest rate policies of the USA has kicked the can and has created a situation where it will be prolonged and this extra credit and leveraging has now also got to be purged.

Deflation is quite simple. Sellers (houses, TVs, widgets etc) lower prices to attract a buyer whilst some resfpond many buyers hold off buying because it might be cheaper next week, sellers further lower prices and around it goes in a spiral.

Gold (the ultimate only(?) Safe Haven)

A simple correlation rule of thumb allows us to predict that gold will be at $1,950 by the end of the year if it simply retains it close correlation to the debt ceiling. Should Bernanke announce that he will additionally need to monetize some or all of this incremental debt amount, we anticipate that gold will be well over $2,000 by the end of the year, courtesy of yet another round of accelerated dollar debasement, which also means that real gains in US stocks will be negated courtesy of the devaluation of the currency in which they are priced. The same, however, does not apply for gold, which with every passing day is priced in nothing but itself.

Australia (my 2c)

Australia is 4 years behind Spain.

You can’t have private debt @120% of GDP and ignore it especially if its backed by house prices. Further the banks are on the hock for a nett $680B to overseas lenders to support the property bubble.

Now slice say 20% off the underlying housing assets and lets stab at $250B written off. Add a good dose of global credit freeze (say TEDSPREAD >200), nice dash of state debt downgrades, and the only one left to bail out anything is Canberra with its AAA.

Now, do Canberra ‘borrow’ $200 or $300B thereby to inact some Krugman/Keynsian bollocks (that will fail anyway) that will put them in the Spain or Italy vicinity (total eternal debt to GDP circa 150%) clubs or just let the whole thing fail (Austrian) and rebuild after?

The elephant in the room is our massive (mostly private) debt to GDP its what keeps our economy alive (property ponzi feeding services and retail). Meanwhile the masses are fascinated by the Block and Masterchef and the politicians straight faced lie and wax lyrical. Yes Mr Swan Australia is a world away from Europe, just like Lehmann Bros was a Wall St firm a world away...until TEDSP spikes and global credit freezes. Then we are real close.

Notes: TEDSPREAD definition and what it implies. TEDSPREAD Definition and Meaning. and TEDSP:IND Graph

Super Assets (more offtrack observation)

As an aside I was bemused this week to read and hear in the MSM about punters fretting over their lost Super assets. Who the f&@* would have their retirement assets exposed to the stock market in these times where anyone with an IQ on the right side of the bell curve knows a Tsunami is brewing?

Plenty it seems. I came across very intelligent folk who have their super in 'High Growth'. Why is it called that? Why not call it "Have A Punt" or "Its All Been Put on Red". I ask these folk to ask themselves if the employer gave you $20,000 a year to invest would you put in a bank or the stock market?

In 4 years since the ASX was climbing with no end in sight and the US housing crash and global deleveraging storm was a nutters wish list (my super fund):

High Growth approx -19%

Cash +19%

Inflation +12.5%

So in 4 years, Cash is ahead of inflation by 6.5%, ahead of High Growth by 38%. High Growth is 31.5% behind the inflation curve.

- $100,000 in 2007 is $119,000 today in Cash

- $100,000 in 2007 is $81,000 today in High Growth

- When you lose 50% in an asset you need to make 100% to get back to square 1.

- When you lose 15% off your Super (approx 25year to go) thats an extra year or two you have to work to make that back (a loss of a single 15% this year equates to a payout of about $60,000 less in 20 years and $80,000 less in 25 years).

Positions: I rarely go into a weekend with open FX positions but this weekend I am short AUDJPY, GBPJPY, EURCHF and Suncorp (what a lemon) all deep in the money, I have no bullish positions at the moment but am trying to find a good entry to long a Gold contract.

Tomorrow Should Be A Hoot!!

_thumb%5B2%5D.jpg)