Leith van Onselen at Macrobusiness has posted an outstanding article on Chinese credit issuance. Chinese Banks Feeling the Heat.

Chinese banks’ aggressive credit expansion in the past two years greatly facilitated China’s strong economic recovery during the global financial crisis. Since the beginning of 2009 until now, total loans at Chinese banks grew by 65%. In other words, close to 40% of their total loans were lent out in the past two and a half years, especially in 2009 when the world was in a financial crisis. China’s financial system is highly leveraged with the ratio of bank loans to GDP already hitting 120%, higher than the peak level of Japan during its financial bubble. This ratio could be even higher if offbalance sheet loans are factored in

- Close to 40% of their total loans were lent out in the past two and a half years

- China’s financial system is highly leveraged with the ratio of bank loans to GDP already hitting 120%

Did someone say credit fuelled bubble?

The rapid westernisation and industrialisation over the last 20 years has indeed been something to behold.

Impressive.

Has any other non Western nation experienced such rapid industrilisation, westernisation and modernisation?

Japan early 20th century.

http://eh.net/encyclopedia/article/mosk.japan.final

Japan achieved sustained growth in per capita income between the 1880s and 1970 through industrialization. Moving along an income growth trajectory through expansion of manufacturing is hardly unique. Indeed Western Europe, Canada, Australia and the United States all attained high levels of income per capita by shifting from agrarian-based production to manufacturing and technologically sophisticated service sector activity.

Still, there are four distinctive features of Japan's development through industrialization that merit discussion:

1. The proto-industrial base

Japan's agricultural productivity was high enough to sustain substantial craft (proto-industrial) production in both rural and urban areas of the country prior to industrialization.

2. Investment-led growth

Domestic investment in industry and infrastructure was the driving force behind growth in Japanese output. Both private and public sectors invested in infrastructure, national and local governments serving as coordinating agents for infrastructure build-up.

- Investment in manufacturing capacity was largely left to the private sector.

- Rising domestic savings made increasing capital accumulation possible.

- Japanese growth was investment-led, not export-led.

3. Total factor productivity growth -- achieving more output per unit of input -- was rapid.

On the supply side, total factor productivity growth was extremely important. Scale economies -- the reduction in per unit costs due to increased levels of output -- contributed to total factor productivity growth. Scale economies existed due to geographic concentration, to growth of the national economy, and to growth in the output of individual companies. In addition, companies moved down the "learning curve," reducing unit costs as their cumulative output rose and demand for their product soared.

The social capacity for importing and adapting foreign technology improved and this contributed to total factor productivity growth:

Shifting out of low-productivity agriculture into high productivity manufacturing, mining, and construction contributed to total factor productivity growth.

- At the household level, investing in education of children improved social capability.

- At the firm level, creating internalized labor markets that bound firms to workers and workers to firms, thereby giving workers a strong incentive to flexibly adapt to new technology, improved social capability.

- At the government level, industrial policy that reduced the cost to private firms of securing foreign technology enhanced social capacity.

4. Dualism

Sharply segmented labor and capital markets emerged in Japan after the 1910s. The capital intensive sector enjoying high ratios of capital to labor paid relatively high wages, and the labor intensive sector paid relatively low wages.

Dualism contributed to income inequality and therefore to domestic social unrest. After 1945 a series of public policy reforms addressed inequality and erased much of the social bitterness around dualism that ravaged Japan prior to World War II.

The parallels are remarkable. Dualism is the catalyst.

After the Tokugawa government collapsed in 1868, a new Meiji government committed to the twin policies of fukoku kyohei (wealthy country/strong military) took up the challenge of renegotiating its treaties with the Western powers. It created infrastructure that facilitated industrialization. It built a modern navy and army that could keep the Western powers at bay and establish a protective buffer zone in North East Asia that eventually formed the basis for a burgeoning Japanese empire in Asia and the Pacific.

Central government reforms in education, finance and transportation

Jettisoning the confederation style government of the Tokugawa era, the new leaders of the new Meiji government fashioned a unitary state with powerful ministries consolidating authority in the capital, Tokyo. The freshly minted Ministry of Education promoted compulsory primary schooling for the masses and elite university education aimed at deepening engineering and scientific knowledge. The Ministry of Finance created the Bank of Japan in 1882, laying the foundations for a private banking system backed up a lender of last resort. The government began building a steam railroad trunk line girding the four major islands, encouraging private companies to participate in the project. In particular, the national government committed itself to constructing a Tokaido line connecting the Tokyo/Yokohama region to the Osaka/Kobe conurbation along the Pacific coastline of the main island of Honshu, and to creating deepwater harbors at Yokohama and Kobe that could accommodate deep-hulled steamships.Geographic economies of scale in the Tokaido belt

Not surprisingly, the merchants in Osaka, the merchant capital of Tokugawa Japan, already well versed in proto-industrial production, turned to harnessing steam and coal, investing heavily in integrated spinning and weaving steam-driven textile mills during the 1880s.

Concentration of industrial production first in Osaka and subsequently throughout the Tokaido belt fostered powerful geographic scale economies (the ability to reduce per unit costs as output levels increase), reducing the costs of securing energy, raw materials and access to global markets for enterprises located in the great harbor metropolises stretching from the massive Osaka/Kobe complex northward to the teeming Tokyo/Yokohama conurbation. Between 1904 and 1911, electrification mainly due to the proliferation of intercity electrical railroads created economies of scale in the nascent industrial belt facing outward onto the Pacific. The consolidation of two huge hydroelectric power grids during the 1920s -- one servicing Tokyo/Yokohama, the other Osaka and Kobe -- further solidified the comparative advantage of the Tokaido industrial belt in factory production. Finally, the widening and paving during the 1920s of roads that could handle buses and trucks was also pioneered by the great metropolises of the Tokaido, which further bolstered their relative advantage in per capita infrastructure.Organizational economies of scale -- zaibatsu

In addition to geographic scale economies, organizational scale economies also became increasingly important in the late nineteenth centuries. The formation of the zaibatsu ("financial cliques"), which gradually evolved into diversified industrial combines tied together through central holding companies, is a case in point. By the 1910s these had evolved into highly diversified combines, binding together enterprises in banking and insurance, trading companies, mining concerns, textiles, iron and steel plants, and machinery manufactures. By channeling profits from older industries into new lines of activity like electrical machinery manufacturing, the zaibatsu form of organization generated scale economies in finance, trade and manufacturing, drastically reducing information-gathering and transactions costs. By attracting relatively scare managerial and entrepreneurial talent, the zaibatsu format economized on human resources.

But...

Emergence of the dualistic economy

With the drive into heavy industries -- chemicals, iron and steel, machinery -- the demand for skilled labor that would flexibly respond to rapid changes in technique soared. Large firms in these industries began offering premium wages and guarantees of employment in good times and bad as a way of motivating and holding onto valuable workers. A dualistic economy emerged during the 1910s. Small firms, light industry and agriculture offered relatively low wages. Large enterprises in the heavy industries offered much more favorable remuneration, extending paternalistic benefits like company housing and company welfare programs to their "internal labor markets." As a result a widening gulf opened up between the great metropolitan centers of the Tokaido and rural Japan. Income per head was far higher in the great industrial centers than in the hinterland.

The deja vu is getting spooky.

And the dualism?

China's billionaire explosion

The World's Billionaires list that Forbes published on March 10 - the eighth such list that Flannery has contributed to since he opened the company's Shanghai bureau in 2003 - featured 115 people from the Chinese mainland, compared to 64 in the previous year.

Wages in China

Annual average income for employees in Shanghai reached around 65,000 CNY (10,000 USD) in year 2011. Average salary for software engineer/developer in China is around 100,000 CNY (15,400 USD). More experienced software senior developers receive around 150,000 CNY (25,000 USD) and more.

Factories are increasing payments to workers. Governments are raising minimum wages.

The incomes of factory workers are still low compared to the workers in United States and Europe. The hourly earning in southern China is only about 80 cents per hour.

Billionaires, Poor wages (by global standards) and Peasants. Dualism? Thats Treblism (is that a word?).

What happens next? It pops...

Export Led Boom and Bust

The export-led boom was broad-based. All industries benefited. Among them, marine transportation and shipbuilding were extremely profitable and expanded most strongly. Between 1913 and 1919, total manufacturing output rose 1.65 times while individual industries enjoyed the following output increases: machinery (3.1 times), steel (1.8 times), chemicals (1.6 times) and textile (1.6 times).

Clearly, this export-led boom was temporary (only as long as WW1 continued, which meant about 4 years). Japanese manufacturing was still internationally uncompetitive in cost and quality. Japan was capturing overseas markets under the special condition of the European war, which artificially boosted both the demand for and the prices of Japanese exports. Domestically, too, quick import substitution was possible because European goods did not arrive. In retrospect, most of the business expansion during WW1 was inefficient, excessive and unsustainable.

Because of the unprecedented boom, mediocre merchants and producers became suddenly rich and greatly expanded their enterprises. A class of nouveau riche called narikin emerged (in Japanese chess, narikin means a pawn becoming a gold general). They were often without culture or taste and fond of showing off their material wealth.

WW1 required very little military operation from Japan. Japan did not engage in any serious combat. But Japan had a military alliance treaty with the UK (1902-1923, with Russia as the potential enemy), so the government used this treaty as an excuse for capturing German-occupied territories in Jiaozhou Wan (around Qingdao) in China and islands in the Southern Pacific.

In 1918 when WW1 ended, a small business setback occurred. But the economy continued to do well in 1919. Then came the big crash of 1920. This postwar recession meant that the bubble had finally collapsed. Serious price deflation was recorded in many key commodities. Within the year of 1920, the price of cotton yarn fell by 60%, that of silk by 70%, and the stock market index plunged 55%. There was no downward price rigidity in those days. Macroeconomic adjustment was effected mostly in prices and less in output.

When the bubble ended, the lack of competitiveness and overcapacity of the Japanese economy, previously hidden under unsubstantiated exuberance, was now exposed. Most narikin were bankrupted. Their happy days were short.

After that and throughout the 1920s, Japan went through a series of recession and a few banking crises (the biggest bank runs occurred in 1927--see lecture 8). The economy slowed down significantly compared with the WW1 period, but no severe fall in output occurred. Domestic demand was not buoyant but steady. Recessions were frequent but short-lived. Prices remained flexible. Trade deficits returned and persisted, financed by the drawing down of the previously accumulated gold reserves. During the 1920s, the sky above the Japanese economy was neither sunny nor pouring. It was as if thick clouds gathered and stayed above the economy, depressing the economic mood of the country (a bit like now, since the 1990s).

Faced with the onset of a long recessionary period, it is noteworthy how the Japanese government reacted. It had two policy options: to rescue weakened industries and banks saddled with bad debt, or to eliminate inefficient units in order to streamline the economy despite transitional pain. The Japanese government chose the first option. In particular, the Bank of Japan provided emergency loans to ailing banks and industries to avoid further bankruptcies and unemployment. This policy eased the short-term pain but implanted a time bomb in the Japanese economy which exploded several years later.

So who else shares this view? Plenty but the Japan 1920s parallel was suggested by Hugh Hendry (2010).

2012 - 2013 sits with me.

“There are striking parallels with Japan in the 1920s, when ultimately the whole system collapsed,” said Hendry, 41, whose firm manages $420 million in assets. “China could precipitate a much greater crisis elsewhere in the world.”

Japan’s export boom collapsed after the war amid excess global capacity, slashing growth and sparking a stock-market crash and bank runs.

Hendry’s flagship Eclectica Fund, a global macro hedge fund with $180 million in assets, may gain almost $500 million from its options if China’s economy plunges into a recession, he said. The options cost the fund about 1.5 percent of its net asset value annually, Hendry said.

China’s vulnerability to a crash comes from the “inherent instability” created by a lending binge for infrastructure projects that’s “unprecedented in 400 years of economic history,” Hendry said. The country is also exposed to exports to a U.S. economy that could shrink from $14.6 trillion at the end of March to $10 trillion within 10 years, he said.

“China’s at the mercy of a credit bubble,” Hendry said. “Once you’ve unleashed the genie it’s out there. They are ultimately unstable and it’s that instability that creates their demise.”

China’s bubble may burst within a year or it may take three years, as Citigroup Inc. economists Willem Buiter and Shen Minggao estimate, Hendry said.

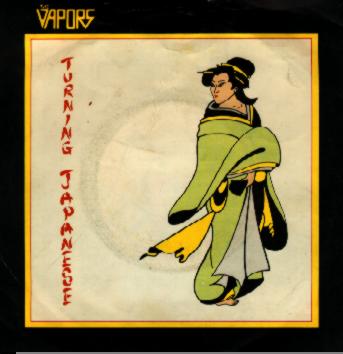

The narikin in caricature: he burns a 100 yen

note for light so the girl can find his shoes.

No comments:

Post a Comment