History never repeats,

I tell myself before I go to sleep.

Don't say the words you might regret,

I lost before, you know I cant forget.

You say I always play the fool,

I can't go on if thats the rule,

Better to jump than hesitate,

I need a change and I cant wait.

800 years of bursting bubbles and financial folly analysed in one book. This Time Is Different is a book by Carmen Reinhart and Kenneth Rogoff that makes the compelling case that it’s always not different and history indeed does repeat.

As Carmen Reinhart and Kenneth Rogoff show in "This Time Is Different," financial catastrophe is invariably preceded by periods of prosperity and New Era rationalizations.Messrs. Reinhart and Rogoff have compiled an impressive database, which covers eight centuries of government debt defaults from around the world. They have also collected statistics on inflation rates from every country where information is available and on banking crises and international capital flows over the past couple of centuries. This lengthy historical study gives what they call a "panoramic view" of the unending cycle of boom and bust, showing how claims that "this time is different" are invariably proven wrong.

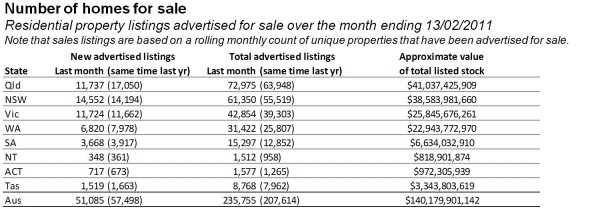

Reinhart and Rogoff demonstrate that financial meltdowns typically follow real-estate bubbles, rising indebtedness and gaping current-account deficits.

"This Time Is Different" doesn't simply explain what went wrong in our most recent crisis. The book also provides a roadmap of how things are likely to pan out in the years to come. [b]Real-estate bubbles invariably give way to banking crises. Losses in the financial sector are followed by the sharp deterioration in government finances amid bailouts and decreased tax revenue. The decline in economic output that follows the bust is sharp, but the recovery tends to be slow and protracted. The situation is especially dire when the crisis is geographically widespread.

Wait there's more...

The authors present eight centuries of financial folly, demonstrating the common theme that excessive debt accumulation regardless of the source — government, business or consumer — poses greater systemic risks than it seems at the time of the boom. (MoneyWatch recently interviewed Reinhart for her views on the current state of the economy.)

- Infusions of cash make a government look like it’s providing greater growth than is actually being provided.

- Private-sector borrowing binges inflate housing and stock prices beyond sustainable levels and make banks seem more stable and profitable than they really are.

- Large-scale buildups of short-term debt make an economy vulnerable to crisis of confidence.

They demonstrate that financial crises are protracted affairs that share three characteristics:

- The aftermath of banking crises is associated with deep declines in output and employment. Unemployment rises an average of 7 percent over cycles lasting more than four years on average. Output falls more than 9 percent over two-year periods, and it has taken about four-and-a-half years for output to fully recover.

- Government debt surges an average of 86 percent in real terms. The main cause is not spending but a decline in revenues

The bottom line is that the aftermath of crises has a deep and lasting effect on asset prices, output and employment. Unemployment increases and housing price declines have extended for five and six years, respectively. The authors also note that V-shaped recoveries in equity prices are far more common than V-shaped recoveries in real housing prices or unemployment. (2009 is certainly not an exception.)

So lets summarise. AT LEAST a 35% fall in house prices creating a spiralling feedback loop of rising unemployment, falling asset values and business failures.

Its never different.

Those who cannot remember the past are condemned to repeat it. - George Santayana (1905).

Amazon USA

http://www.amazon.com/This-Time-Different-Centuries-Financial/dp/0691142165 (Book)

Amazon UK

http://www.amazon.co.uk/This-Time-Different-Centuries-Financial/dp/0691142165 (Book)